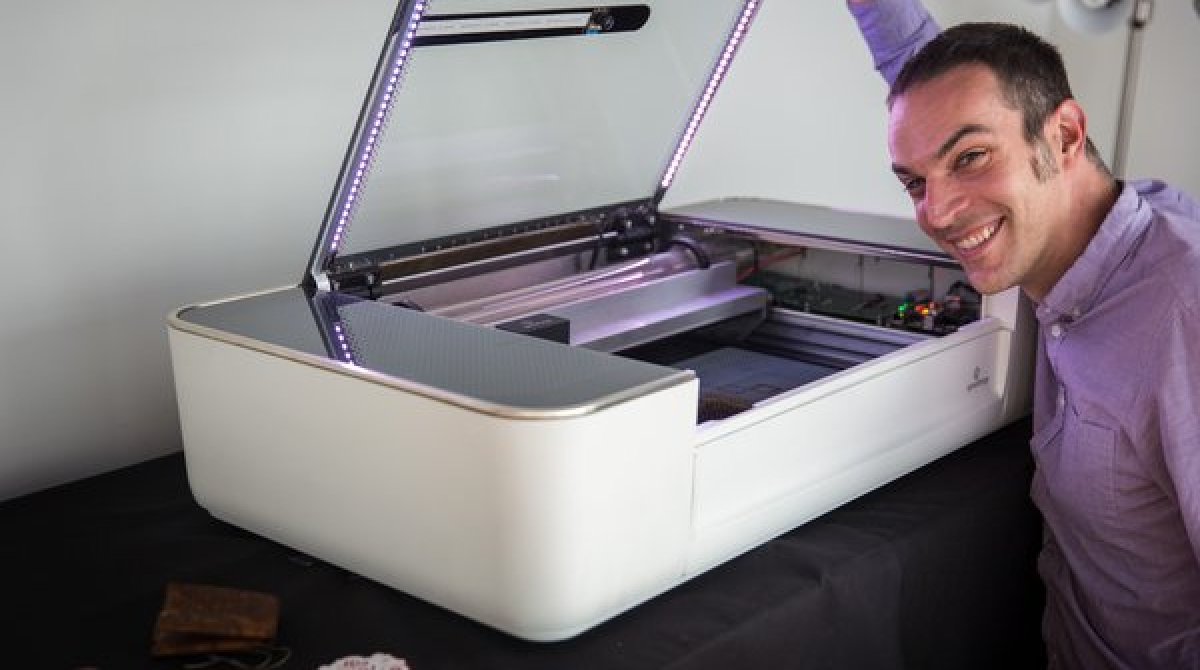

[This post is sponsored Glowforge – get $500 off your laser cutter using our exclusive referral link]

It’s almost the end of the year, which means that 2018 taxes are coming to a close. If you need to add new tools/equipment to your shop, now is a great time to do so!

In years past – when you purchased tools/equipment for your business, you could only write it off through depreciation.

For example, if you spent $5,000 on a new laser cutter, you would only be able to write off $1,000 a year for 5 years.

NEW TO 2018 – you can write off the entire purchase at once thanks to IRS Section 179!

For example, if you spent $5,000 on a new laser cutter on or before December 31st, 2018 – you can write off the full $5,000 for 2018!

Cool Life Hack

Thanks to IRS Section 179, you can now write off the FULL PURCHASE PRICE in 2018 – even if you are leasing or making monthly payments on the machine! Glowforge payments start at $116/month 🙂

Check out more information about IRS Section 179 (and be sure to contact your tax advisor for your exact tax implications).

[This post is sponsored Glowforge – get $500 off your laser cutter using our exclusive referral link]